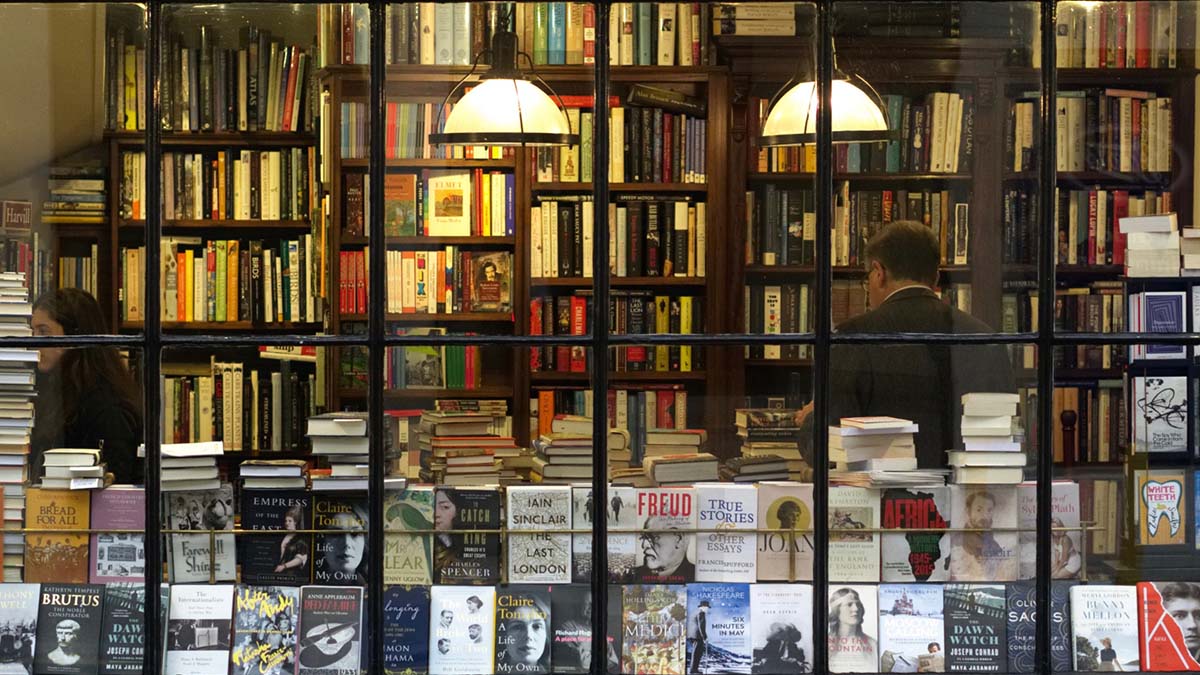

Reading quality books on commercial real estate investing is one of the best ways to improve your knowledge and skill.

In this article, we share our picks for the 15 best books on commercial real estate investing of all time.

These books cover a wide range of topics, from the basics of investing in commercial properties to advanced strategies for maximizing returns. Whether you’re a beginner or an experienced investor, there’s something on this list for everyone. Let’s dive in!

1. “The Millionaire Real Estate Investor” by Gary Keller

“The Millionaire Real Estate Investor” is a book written by Gary Keller, the co-founder of Keller Williams Realty and the chairman of the board of KellerINK. As a phenomenal business owner and real estate investor, it’s no wonder this book does a great job providing readers with a comprehensive guide to investing in real estate, focusing on building wealth and achieving financial independence.

The book is a compilation of the knowledge and experience of over 100 millionaire investors from various backgrounds who sought financial success and the freedom it brings. This book offers their tried-and-true tactics in an easy-to-read, straightforward format. This book is a classic in the residential and commercial real estate investing world for a reason.

2. “Real Estate Riches: How to Become Rich Using Your Banker’s Money” by Dolf de Roos

Dolf de Roos’s Real Estate Riches, a timeless bestseller, teaches you how to uncover fantastic bargains and generate profits in the real estate market. You’ll discover why real estate is such a dependable source of income and how to get the most return on your investment. This book teaches you how to find the best properties with the most potential, analyze deals, determine cap rates, negotiate and submit offers, effectively manage properties, and significantly increase your real estate value without spending much of your own money. It is full of time-honored wisdom, tried-and-true strategies, and simple tips that will support your commercial real estate transactions.

3. “The ABCs of Real Estate Investing” by Ken McElroy

The ABCs of Real Estate Investing, written by Ken McElroy, shows you how to locate, finance, negotiate, oversee, and profit from multifamily properties. Ken is a Rich Dad Advisor and owns one of the most prominent property management organizations in the Southwest of the United States. His book contains valuable information and a tried and true roadmap you can use to invest in commercial real estate.

One of the unique focuses of this book is property management, which is a crucial subject that many authors skim over, but Ken devotes a significant amount of his book to it. He emphasizes how vital property management is to a venture’s profitability. He explains everything regarding property management, from how to employ a company to how to fire a management company and what it takes to run a successful property management company on your own.

4. “The Book on Rental Property Investing” by Brandon Turner

Real estate investors worldwide are employing the tactics outlined in The Book on Rental Property Investing to generate sizable cash flow from rental properties. While this book is more geared towards residential real estate investors, it outlines the fundamentals of real estate investing in a friendly and easy-to-understand way that can easily be applied to commercial real estate investing.

In the book, the former longtime BiggerPockets Podcast co-host and active real estate investor Brandon Turner explains the tried-and-true methods he employed to create his real estate fortune. Turner shows how to develop a plan, uncover amazing deals, analyze properties, build a team, finance rentals, and much more. All in all, if you want to get started with foundational strategies that will help you get your first deal, this practical guide is a great place to start.

5. “The Real Estate Game” by William J. Poorvu and Jeffrey Cruikshank

The Real Estate Game is a comprehensive manual for running a profitable commercial real estate business. William Poorvu provides an insider’s view on how to make wise real estate decisions by drawing on his forty years of expertise in real estate development, ownership, and management and his nearly thirty years of teaching experience at the Harvard Business School. People play the real estate “game,” and their stories provide Poorvu’s book with a depth of color and interest. Real estate tycoons, small-scale developers, and private investors are just a few participants you’ll learn from in the book.

Poorvu demonstrates to readers how to enter the real estate market for various properties, including residential, office, hotel, industrial, and retail, using this tool and others. He also illustrates how factors, such as participants, properties, capital markets, and the outside environment, all interact to form and determine the outcome of a real estate deal in simple, non-technical language. He leads the reader through the critical “periods of play” in the real estate game, including concept, commitment, development, operation, reward, and reinvestment. He also explains the time frames for various real estate investments.

6. “Commercial Real Estate Investing For Dummies” by Peter Conti and Peter Harris

If you’re looking for more specific market guidance for commercial real estate than just “Buy low, sell high” and want to understand the fundamentals of commercial real estate investing, this book is for you. In Commercial Real Estate Investing for Dummies, you’ll find the intelligent, clear-cut information you need to get started—or expand your portfolio.

Peter Conti and Peter Harris build off of their extensive personal experience in this best seller book that outlines the essentials you need to succeed in the commercial real estate market. It’s a great handbook that will help inform your investment strategy and provide you with a competitive edge you can use to make wise investment decisions. In the book, you’ll learn the fundamental tactics and techniques for investing in various commercial assets and property types, including malls and apartments. You’ll also receive sound guidance on working with commercial real estate brokers, finding good property managers, tax strategies, working with investment partners, and much more. In short, this is a great way to become familiar with investing in the commercial real estate industry.

7. “The Commercial Real Estate Investor’s Handbook: A Step-by-Step Road Map To Financial Wealth” by Steven D. Fisher

The Commercial Real Estate Investor’s Handbook is a great way to learn how to profit by investing in various commercial real estate, such as offices, warehouses, apartments, mobile home parks, shopping malls, hotels, and other income-producing properties. This thorough book offers priceless guidance on spotting possibilities, estimating property values, buying, financing, and managing commercial real estate.

This in-depth, step-by-step proven training explains the ins and outs of commercial real estate investing to both novices and seasoned veterans. You won’t have to reinvent the wheel or commit the same errors that others have. You’ll be equipped with hundreds of original ideas from this brand-new, thoroughly researched book that you can apply immediately.

8. “Mastering the Art of Commercial Real Estate Investing: How to Successfully Build Wealth and Grow Passive Income From Your Rental Properties” by Douglas Marshall

Doug Marshall is a real estate finance and investment expert with more than 35 years of expertise in commercial real estate, including ten years of personal investment in rental properties. In Mastering the Art of Commercial Real Estate Investing, Marshall imparts his experience to demonstrate how commercial real estate investments can supplement or even completely replace your current income. Written for individuals new to investing and those needing assistance getting to the next level with time-tested fundamentals, Mastering the Art of Commercial Real Estate is an excellent book for commercial investors.

9. “Long-Distance Real Estate Investing: How to Buy, Rehab, and Manage Out-of-State Rental Properties” by David Greene

Out-of-state investing has often been regarded as hazardous and foolish, and it can feel scary or uncomfortable if you’ve never done it before. However, the markets, technology, and rules have evolved, so you are no longer restricted to investing in your local area.

In Long Distance Real Estate Investing, real estate agent and investor David Greene explains how he acquired a multi-million dollar portfolio by purchasing, managing, and reselling properties outside his home state—often without ever having set foot on the property. To help you avoid mistakes and accelerate your learning curve, David offers every strategy, technique, and the system he has implemented for more than twenty rental properties. While primarily written for residential investors, this book can help you become comfortable investing in commercial real estate outside your local area, opening up a potential world of profit.

10. “Crushing it in Apartments and Commercial Real Estate: How a Small Investor Can Make it Big” by Brian Murray

When Brian Murray acquired his first piece of commercial real estate, he was no expert investor. He was a teacher trying to generate additional revenue. He developed a straightforward way of investing that he still employs at his multimillion-dollar real estate business today.

The beginner’s investing guide Crushing It in Apartments and Commercial Real Estate is based on Murray’s journey from novice investor to award-winning CEO of Washington Street Properties. Regardless of your level of experience or the amount of cash you have on hand, this book helps you get started by learning the secrets to Murray’s success in plain-spoken, doable advice.

11. “Raising Capital for Real Estate: How to Attract Investors, Establish Credibility, and Fund Deals” by Hunter Thompson

Raising financing is one of the most valuable and in-demand abilities in real estate; you can always find a deal in the world of investment real estate if you properly master how to raise capital. Unfortunately, there is a widespread misconception that the money will magically appear across the real estate industry if you have a terrific deal. Nothing is further from the truth in real life, though. The chance will slip through your fingers and into the hands of your competitors who have the potential to bring millions to the table when it comes time to close, no matter how beautiful your proposal may appear on paper.

Written by Hunter Thompson, the founder and Principal of Asym Capital, this book teaches you how to display key momentum indicators that inspire high-performing real estate mentors to give you the playbook of their success, create a beautiful offering deck that will help you influence people and “wow” your potential investors, conduct compelling recorded webinars which motivate investors to move forward, establish that you are an expert within the first 5-30 seconds of an investor call, the phrases to use when establishing a significant investment commitment, and more.

12. “Raising Private Capital: Building Your Real Estate Empire Using Other People’s Money” by Matt Faircloth

In Raising Private Capital, author and real estate investor Matt Faircloth provides advice on how to build long-term wealth based on his own real estate experiences and insights. Throughout the book, you’ll discover the real reasons behind victories and setbacks in your real estate investing journey from someone who has gone through it all. Additionally, you will learn a thorough plan to get, secure, and protect private money in your first—or next—real estate deal, whether you are a novice or an experienced real estate investor.

13. “Best Ever Apartment Syndication Book” by Joe Fairless and Theo Hicks

The Best Ever Apartment Syndication Book is an excellent step-by-step guide for completing your first multifamily syndication agreement and creating a multimillion or multibillion-dollar apartment investing empire. In the book, you will learn the precise steps Joe Fairless used to go from earning $30,000 annually at an advertising agency in New York City to holding control of over $572,000,000 in apartment complexes and achieving financial freedom. If you are interested in apartment buildings, this step-by-step roadmap is considered the ultimate beginner’s guide. Shave years of experience off your learning curve by reading through this intelligent guide that will help you improve your decision making as a real estate entrepreneur and help you build financial wealth more quickly by learning from experienced investors.

14. “The How To Add Value Handbook For Commercial Real Estate: Generate More Income From Your Investment Property” by Brian Hennessey

This book is jam-packed with crucial details and offers the step-by-step instructions required to increase the value of commercial real estate investments. Whether investing in office and industrial, retail, or multi-family properties, this information can be used for various commercial real estate investment strategies. This book contains very teachable concepts that may be quickly applied to boost the cash flow of your home significantly.

You’ll learn how to determine the best way to price the rental value of your investment property to get it leased at the highest rent, tips and strategies to make your property attract tenants, how to interview and hire the right people that will help you get your property leased, how to structure your lease rate and terms to create the most value, and much more. All in all, this is a great read that will help ensure you can increase the amount of value added to every deal you do.

15. “What Every Real Estate Investor Needs to Know About Cash Flow…And 36 Other Key Financial Measures” by Frank Gallinelli

What Every Real Estate Investor Needs to Know About Cash Flow teaches commercial real estate investors how to analyze the numbers of a deal like an expert. It’s a complete guide that breaks down complex concepts in a way perfect for new investors by eliminating the guesswork from real estate investments so you can accurately determine a commercial property’s value and ensure it generates long-term returns. The book will also help you do your due diligence during the evaluation phase of commercial properties, including office buildings, shopping centers, and more.

The practical advice offered in this great book has made Frank Gallinelli’s it a favorite among professional investors. The fundamentals outlined in the book have remained the same for years, and a newly updated second edition includes helpful, in-depth investment case studies that cover apartment, mixed-use, and NNN leases to help you apply the information to real-life.

Summary

Successful commercial real estate investing involves a blend of abilities, know-how, and experience. Success in this industry may be attained, in part, via constant skill development. Reading books authored by professionals in the industry is one approach to do this.

This list of the best commercial real estate books combines years of commercial real estate experience and covers a wide range of topics, from the basics of investing in commercial properties to advanced strategies for maximizing returns. Whether you’re just starting in the world of commercial real estate or an experienced investor looking to expand your knowledge, we hope you find these books to be a great resource in your journey. If you found this list helpful, please share it with a friend or colleague interested in investing in commercial real estate to help them! Lastly, if you’re new to investing and want another resource to start, read our complete guide to real estate investing for beginners.