Learning how to calculate and evaluate multiple real estate investing formulas is one of the best ways to increase your success with commercial real estate investing.

Relying solely on one formula can lead to substantial risk because it may not paint a complete picture of the investment opportunity at hand.

Therefore, it’s important to understand and assess multiple investing formulas to screen properties so you can gauge which real estate deals are worth pursuing, and which ones are worth passing.

The equity multiple is one of those formulas, and it can be a great tool for helping you evaluate potential investments.

In this article, we walk through the steps needed to accurately calculate equity multiples so you can gauge the return (or projected return) of a particular property. Here’s an overview of what we cover. Feel free to skip to the parts that interest you most!

Table of Contents

What is Equity Multiple?

The equity multiple is an effective metric used to measure the performance of real estate investments. The term “equity multiple” is straightforward because it indicates how many times your equity will be multiplied during a hold period.

In a commercial real estate investment, the equity multiple is the total cash distributions received from an investment, divided by the total equity invested.

The equity multiple number gives investors a general understanding of their overall return and how well their investment performed (or is projected to perform). Generally, the higher the equity multiple, the greater returns.

How do you calculate equity multiple in real estate?

The equity multiple calculation for real estate is simple. The formula is:

Total Cash Distributed / Total Equity Invested = Equity Multiple

To understand this equation better, let’s break down the two sides of the equation.

First, “total cash distributed” is the total cash distributions received throughout the holding period plus the initial equity invested. This number includes all cash flow distributions and profits, including profits from periodic events such as cash-out refinances, equity recapitalization, and exits.

Second, “total equity invested” is how much money you initially invested in the deal. It’s important to note that this number does not include money from the property’s net operating income, regular cash flow distributions throughout the hold period, or periodic events. This is strictly how much cash was initially used “out of pocket” to fund the deal.

What is an Example of an Equity Multiple?

Let’s explore examples of an equity multiple through the lens of active and passive investors.

Example of Calculating Equity Multiple for Passive Investors

Alex and Kai are two accredited investors who decide they want to invest in commercial real estate and are searching for a deal where they can invest $100,000.

For their first investment, Alex and Kai want to invest in an industrial property with an equity multiple greater than 1.7.

After connecting with the investor relations team of a few firms, the two investors find sponsors who have an opportunity to invest in industrial property. As Alex and Kai review the deal, they learn that the investment produces a projected annual return of 8.5% over a hold period of five years.

This means that based on the $100,000 Alex and Kai invest, they will receive about $8,500 per year for five years, or $42,500 total.

When the property is sold after five years, Alex and Kai project they will receive another $65,000 in net profit as part of the exit.

To identify the total cash distributed, they add the initial $100,000 investment with the $42,500 from cash flow distributions and the $65,000 of net profit from the exit for a total of $207,500.

Next, to identify the calculated equity multiple, Alex and Kai divide the total cash distributed ($207,500) by the total equity invested ($100,000) for an equity multiple of 2.07.

This means that for every dollar invested, Alex and Kai expect to get $2.07 back in return (including the original $1 invested) and multiply their initial investment by 2.07 its original worth.

Example of Calculating Equity Multiple for Active Investors

Jon is an active commercial real estate investor and finds an office building for $3M.

Jon makes an initial investment of $1M, and after a five-year holding period, the property generated $2.5M in cash distributions (including the original $1M invested).

Using the equity multiple formula, Jon divides $2.5M by $1M to get an equity multiple of 2.5.

This means that for every dollar Jon put into the property, he’s expecting to get $2.50 back (including the original $1 invested).

When is the Best Time to Use the Equity Multiple Formula?

It’s generally most helpful to calculate the equity multiple:

When screening a potential property for a “back of the napkin” projection

When completing the investment underwriting process to project the cash distributions

During and after the holding period to measure the total profits (or how much cash the property generated)

Is it Equity Multiple or Equity Multiplier?

Both “equity multiple” and “equity multiplier” can be used interchangeably, but equity multiple is more commonly used for measuring return on investment in real estate.

What is a Good Equity Multiple in Commercial Real Estate?

The answer as to what constitutes a “good” equity multiple depends largely on each investor’s goals and strategy.

Generally, a higher equity multiple signifies higher returns. However, the ideal equity multiple varies from investor to investor, depending on their particular life stage, experience, needs, market, and aspirations.

For instance, a young value-add investor may prioritize larger gains from properties with a higher potential return from an exit, seeking higher equity multiples and less consistent cash flow. Conversely, an older income-focused investor may be more focused on cash flow and stability from a given property, seeking lower equity multiples with more consistent cash flows rather than bigger growth upside.

Ultimately, investors should always define what “good” means to them and utilize various real estate calculations to target opportunities that fit their criteria.

What Does a 2x Equity Multiple Mean?

A 2x equity multiple means an investor can expect to receive two dollars of return for every dollar of equity invested. Effectively, it’s a simple way to show the potential investment property can double an investor’s money.

What’s the difference between IRR and Equity Multiple?

The Internal Rate of Return (IRR) and Equity Multiple are two metrics used to measure the performance of investments. They’re often used as complementary metrics to one another because they measure returns in different ways.

The IRR measures the percentage rate that each invested dollar earns for each period of time it is invested, whereas the equity multiple measures the amount of cash an investor will earn from a deal.

One of the primary differences of equity multiple vs IRR is that IRR accounts for the time value of money, whereas equity multiple does not.

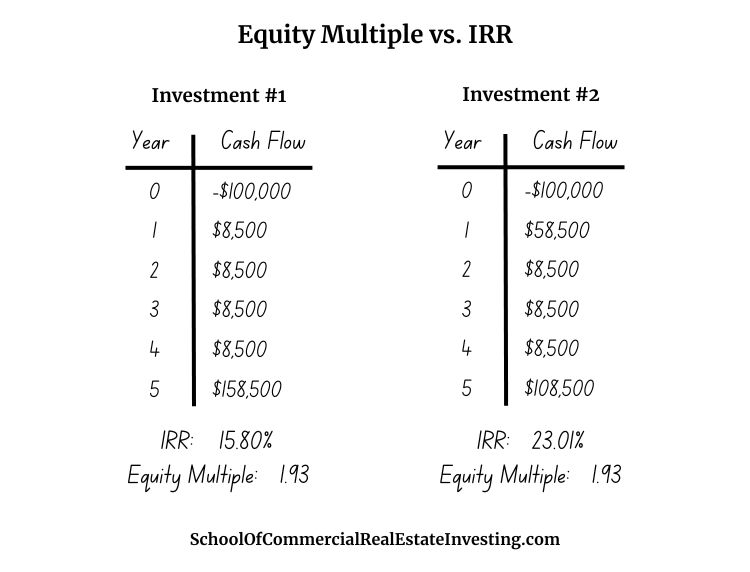

Let’s examine two investments to explore how you might use IRR and equity multiple together to assess an investment opportunity.

When you look at the equity multiple, you’ll see that both investments return the same amount of money to the investor throughout the same holding period. Because of this, both investments earn an equity multiple of 1.93.

But the multiple as a single metric doesn’t paint the full picture.

In this example, Investment #1 generates an IRR of 15.08%, whereas Investment #2 generates an IRR of 23.01%. This is because the IRR accounts for the amount of time the money is invested and when certain returns happen.

Additionally, there are other metrics and factors to consider. While investment #1 cash flows approximately the same as investment #2, the timeline of their capital return and, thus, tax benefits will be different. In investment #2, the investor receives an additional $50,000 at the end of year two, whereas with investment #1, the investor doesn’t receive that $50,000 until year five. If the investor wants to redeploy that $50,000 sooner than five years and has plans to account for the associated taxes of that $50,000 in year two, investment #2 may be the better choice. However, if they prefer to collect steady cash flows for a few years and make a tax plan for the $50,000, Investment #1 may be the better option for them.

These examples highlight a few factors real estate investors should consider when evaluating an investment’s absolute return potential.

Equity Multiple vs Cash on Cash Return

Equity multiple and cash-on-cash returns are similar investment metrics that often get mixed up with one another. While these calculations are similar in commercial real estate, they have one key difference: cash-on-cash returns do not factor in any sales proceeds.

Cash on Cash Return (CoC) evaluates the amount of pre-tax cash that a property can generate for an investor. It’s represented as a percentage of the investment property’s cash flows and is a great way to determine how much an investor needs to invest to generate a certain annual income.

For example, if you invest $100,000 with an 8% cash-on-cash return, you could expect to earn $8,000 from your investment each year.

As you can see, CoC primarily focuses on annual cash flows, whereas equity multiple looks at the overall profitability of a deal throughout the entire hold period (including profits from an exit).

Like equity multiple, CoC does not account for the time value of money.

Why You Shouldn’t Rely Solely On Equity Multiple When Evaluating Private Investments

Investing in commercial real estate is an art and a science. Relying only on one metric like the equity multiple will never help you understand an opportunity thoroughly, and may lead you to make poor decisions.

By establishing that you want an equity multiple greater than X and total cash distributions grater than Y, and then evaluating those alongside other metrics such as the IRR, you’ll better understand whether or not a particular deal will meet your needs and goals.

Conclusion

The equity multiple is a useful formula to help you analyze deals, but it doesn’t account for the time value of money and other factors.

As a result, it’s important to consider a variety of metrics when evaluating an investment opportunity, including IRR, cash on cash return, return on equity, and cap rate.

Ultimately, using a combination of multiple metrics alongside other factors, such as the timeline or tax implications, will help you make more informed investing decisions.