If you want to be a successful money-making real estate investor, you don’t need to take a real estate exam to become a real estate agent with a formal real estate license.

However, you do need to understand and utilize basic real estate math concepts and calculations.

This is because active real estate investing is often a reliable way to build wealth, but it can easily lead to financial disaster if you don’t know what you’re doing.

How do you learn how to know what you’re doing?

You run the numbers.

As a result, the essential real estate math formulas are necessary for all real estate investors to understand because they help you evaluate deals, make calculated decisions, position yourself to earn a good return, and help you sustain your real estate career.

In this article, we review 15 essential real estate math formulas that every active investor should know (and utilize!) before making an investment decision.

Table of Contents

Are Real Estate Math Formulas for Investors Difficult?

The short answer is no. Many real estate investing calculations are pretty simple and can be calculated in a matter of seconds with the use of a calculator once you understand them.

Many new investors wonder how much math they need to know to make wise investing decisions. The truth is that as long as you have a foundational understanding of simple math processes, you’ll be able to understand and use these essential real estate investing formulas.

How Do You Calculate a Good Real Estate Deal?

There are many ways to calculate a real estate deal. Different investors use different combinations of criteria and real estate math formulas to determine whether or not an investment is a good fit for them.

Therefore, to successfully evaluate a deal, you need to determine your investing criteria first and then understand how the essential real estate math formulas can help you assess those criteria.

That may sound like a vague answer, but it’s the truth. Here’s why:

Let’s say you’re a new investor and want to start with a “base hit” type of investment. You may just want to get started and therefore be willing to take on an investment with less potential return than an experienced investor with 300 units in their portfolio. In this instance, you may decide to move forward on an investment in your local area with an 8% cash-on-cash return. In contrast, the experienced investor may only move forward on an investment with a 15% cash on cash return in a specific out-of-state market. These are drastically different criteria, and neither is inherently right or wrong—they’re just different given each investor’s criteria.

Key Takeaway: Establish your investment criteria, then use real estate calculations to evaluate deals based on your criteria.

What Type of Math is Used in Real Estate Investing?

New investors often feel intimidated by real estate investing because of the financial calculations and projections needed to evaluate deals, raise capital, secure financing, and operate properties.

However, if you understand simple algebra (the branch of mathematics that involves variables like x, y, and z and simple operations such as addition, subtraction, multiplication, and division), you’ll likely understand the essential real estate investing calculations quickly.

Sure, it’ll take time to understand real estate math definitions and how they impact one another in a formula. But while more advanced forms of math can be used for other real estate-related specialties (e.g., trigonometry for land surveying and geometry for architectural design), most real estate investing calculations are calculated with basic math operations.

In the following section, we’ll do our best to explain the essential real estate investing formulas in simple terms to make them as approachable as possible for you. It’s okay if you don’t understand them at first glance; take time to write them out on paper and work through them with different scenarios and numbers. Over time, we’re hopeful that you’ll become more comfortable with them and reach the point where you can confidently apply them to real estate math problems in real-life scenarios!

Essential Real Estate Investing Math Formulas

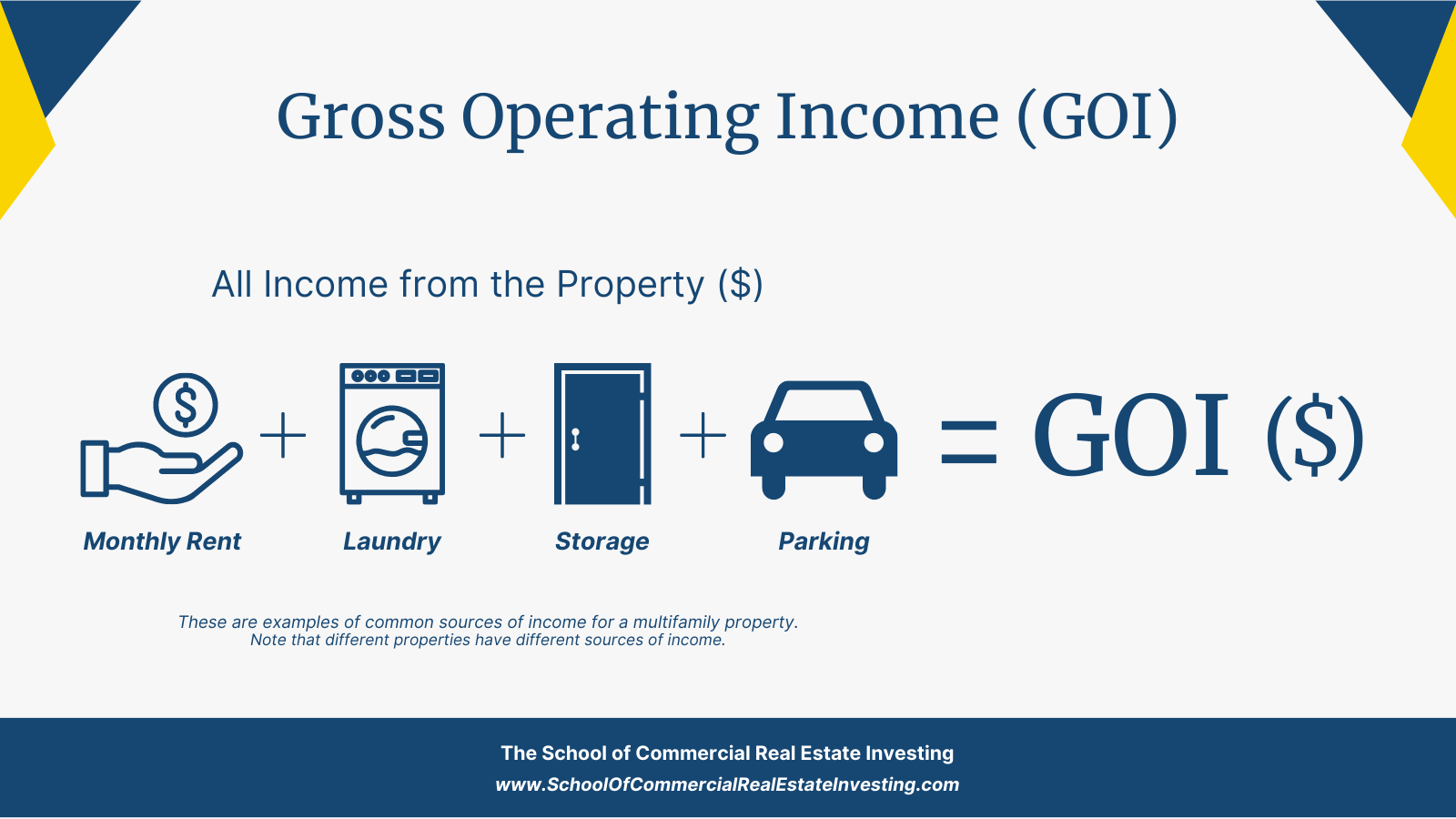

1. Gross Operating Income (GOI)

Gross Operating Income (GOI) in real estate investing is the total revenue a rental property generates before any expenses are considered. To calculate GOI, add all collected revenue that a property generates.

It’s important to emphasize that GOI includes gross monthly income from all sources of gross income, including income from rent, laundry facilities, parking spaces, storage spaces, vending machines, etc.

A high GOI indicates significant revenue to investors, which can be a great sign for investors. However, to be a profitable investment, the property must also be able to manage its expenses.

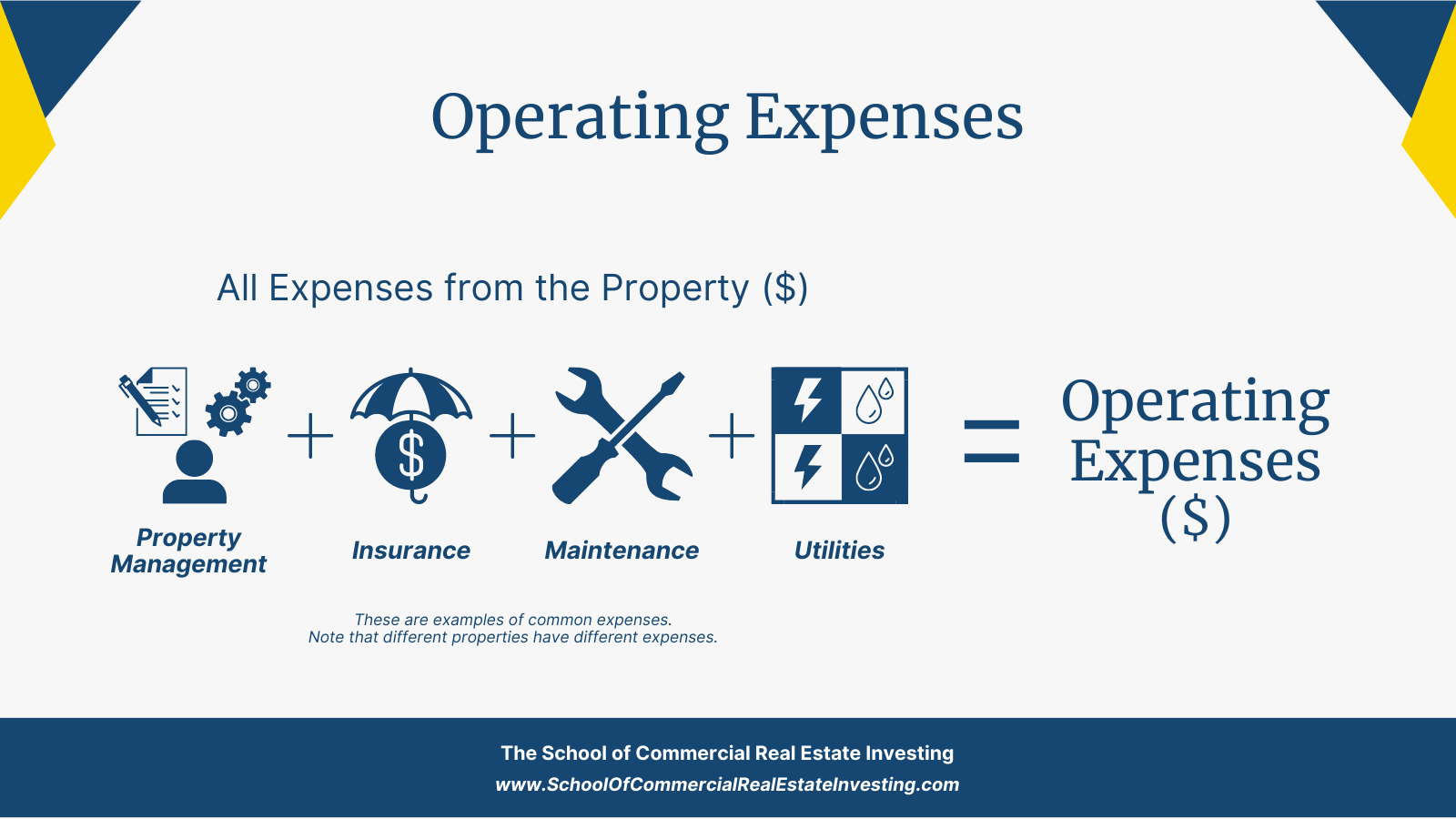

2. Operating Expenses

Operating expenses refer to the costs associated with the day-to-day costs necessary to upkeep and manage a property. These expenses include property tax, insurance, maintenance, repairs, utilities, management fees, landscaping costs, management fees, trash services, and snow removal, among others.

To calculate operating expenses, add all expenses necessary for operating the property.

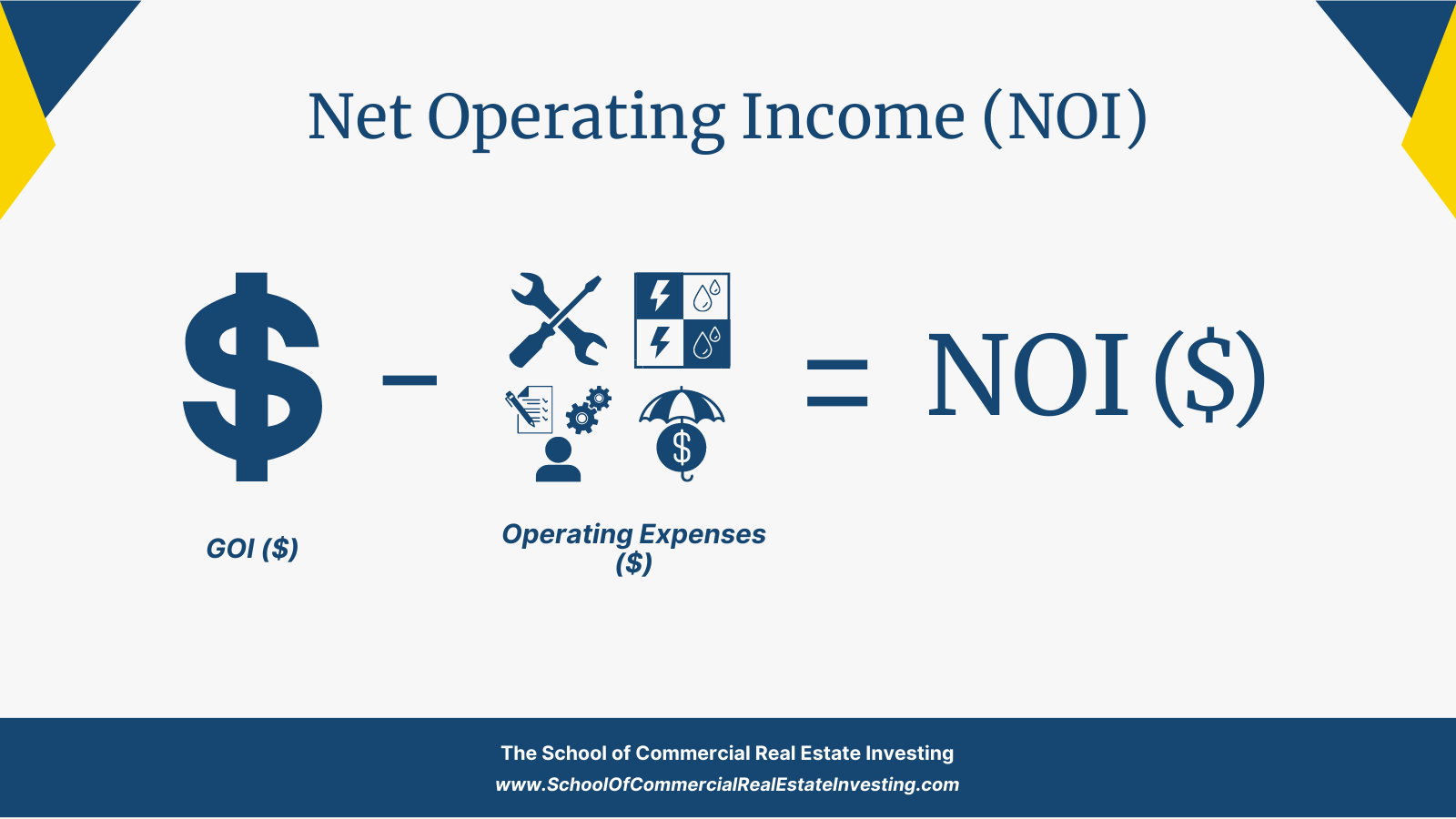

3. Net Operating Income (NOI)

Net Operating Income (NOI) refers to the income generated by a rental property after subtracting its operating expenses. In other words, NOI is the income from the property after accounting for all the costs needed to maintain and manage it.

NOI is argurably the most important metric in real estate investing because it provides insight into a property’s profitability and is heavily used as a variable in other real estate investing formulas.

The NOI is calculated by subtracting a property’s operating expenses from its GOI. In formula form: GOI – Operating Expenses = NOI.

A high NOI indicates a property is profitable after accounting for all its expenses, which is a good sign. A low NOI can indicate that the property needs to generate more income and reduce its expenses to become profitable.

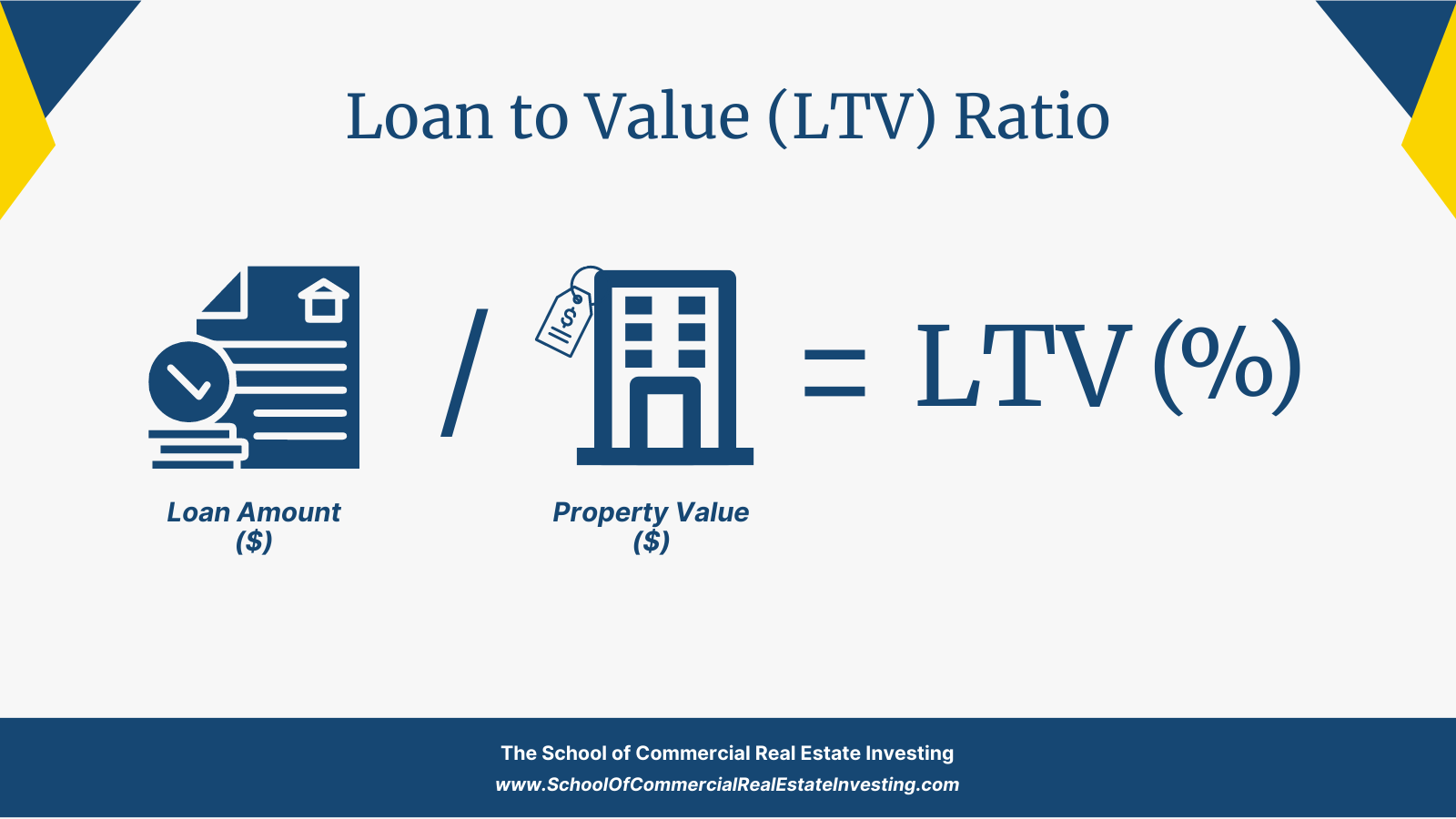

4. Loan-to-Value Ratio

The Loan-to-Value (LTV) Ratio is a critical metric used in real estate investing to help determine how much financing a property requires.

LTV is calculated by dividing the loan amount by the property’s appraised value (or sales price, depending on the lender). In formula form: Loan Amount / Property Value = LTV

The LTV ratio is insightful because it identifies the equity investors hold in a property. A high LTV ratio, such as 80%, indicates an investor financed a more significant percentage of the property’s assessed value and has 20% equity in the property. A low LTV ratio, such as 30%, indicates an investor financed a lower percentage of the property’s value and has 70% equity in the property.

A mortgage lender uses the LTV ratio to help evaluate the risk of financing a property. Many lenders have a minimum LTV they require or won’t consider funding a deal. This is because a higher LTV ratio also indicates a higher risk of default for the borrower because they have less equity in the property to use as collateral in the event of a default. Many lenders require borrowers to maintain a maximum LTV ratio of 70% to 80%, meaning the borrower must provide 20% to 30% of the property’s value as a down payment and keep it in the property at all times.

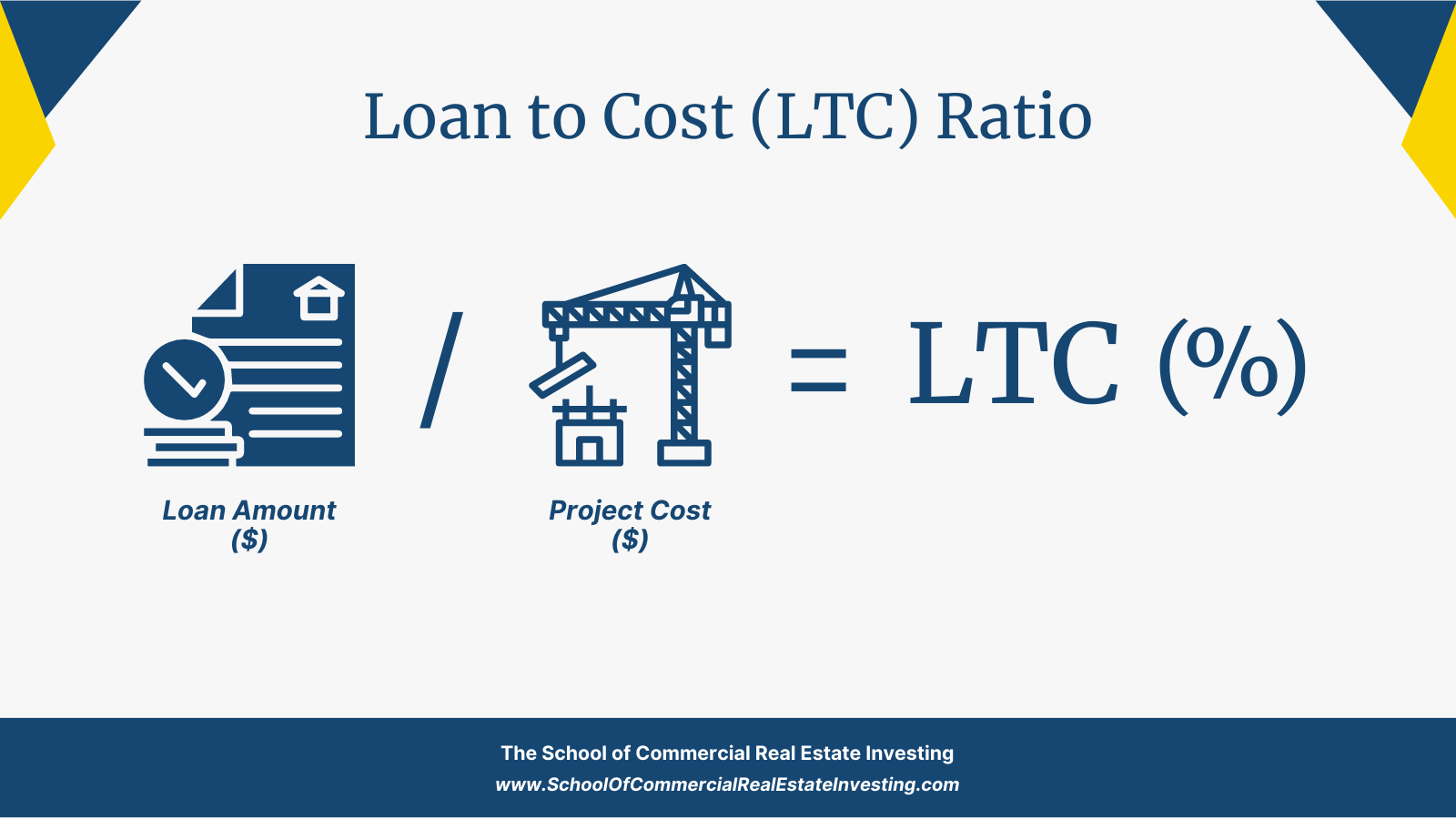

5. Loan-to-Cost Ratio Formula

Loan-to-Cost (LTC) Ratio is used in commercial real estate investing to help determine the amount of financing required relative to the total cost of a construction or development project.

Effectively, LTC is very similar to LTV, but rather than comparing the amount of the loan to the value of the property, it compares the amount of the loan to the cost of construction.

LTC is calculated by dividing the loan amount by the total property development cost. In formula form: Development Cost / Property Value = LTC

Similar to LTV, a low LTC ratio indicates an investor will have more equity in the property when it is completed and financed a smaller percentage of the project’s total cost, which can indicate lower risk and better returns on investment. A high LTC ratio indicates higher financing risk and lower equity in the project.

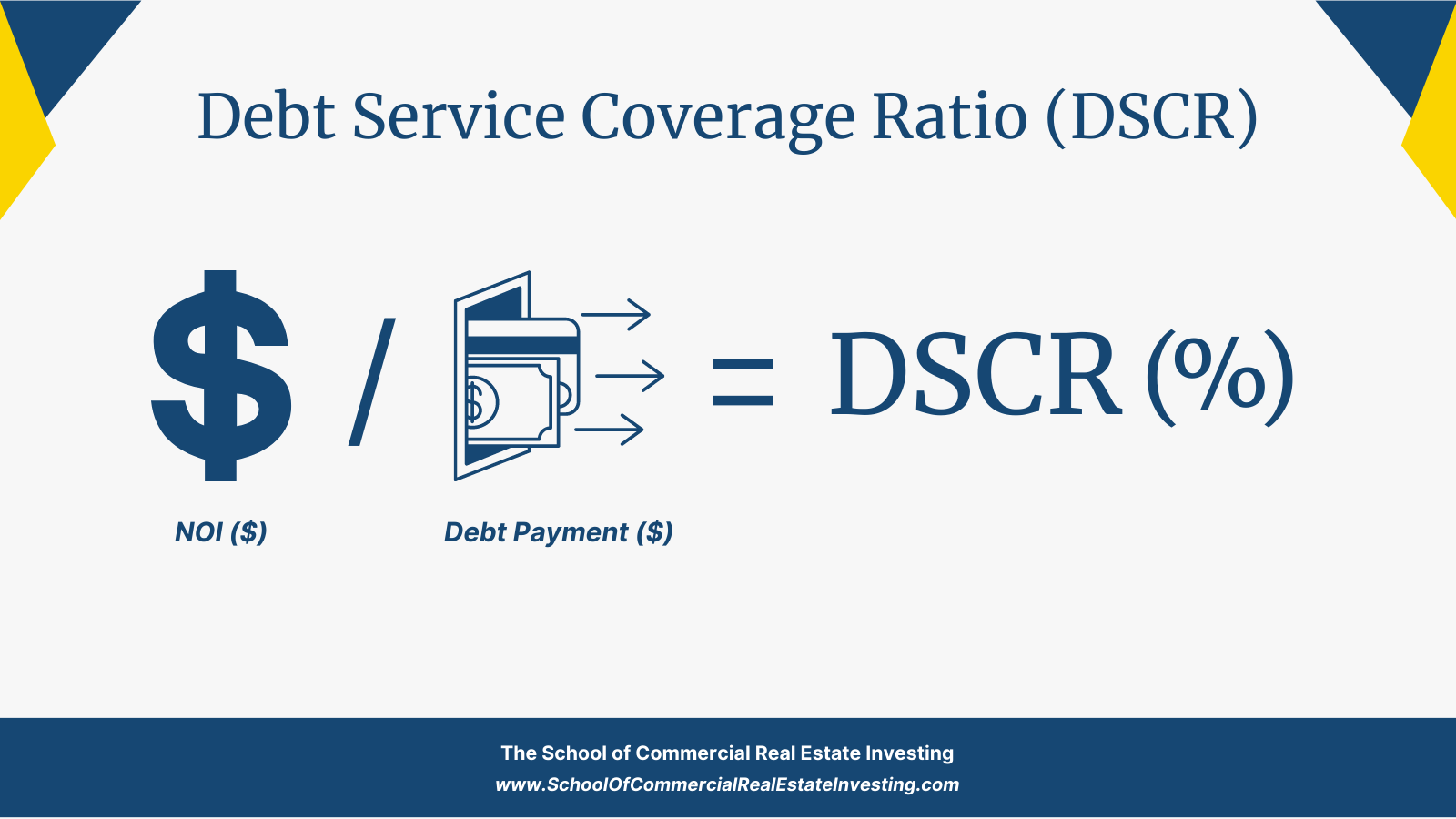

6. Debt Service Coverage Ratio

Debt Service Coverage Ratio (DSCR) is a financial metric used in real estate investing to measure a property’s ability to cover its debt obligations. In other words, it shows how well the income from a property can cover its mortgage and other debts.

DSCR is calculated by dividing the property’s NOI by the cost of its total debt service. In formula form: Monthly NOI / Monthly Debt Payment = DSCR.

Lenders utilize DSCR to evaluate the risk of financing a property by determining if it generates enough income to cover its debt payments. Generally, lenders like to see a DSCR of 1.25 or higher, which means the property’s monthly and annual income is 1.25 times or more than its debt to cover the full mortgage payment and other key expenses like real estate taxes. A higher DSCR indicates a lower risk of default for the borrower, which can lead to more favorable lending terms.

Investors also use DSCR to determine the financial feasibility of an investment property. A higher DSCR means a lower financial risk for the investor and can lead to a more attractive investment opportunity. A low DSCR may indicate the investor or property owner may need to add capital to the property or find ways to increase its income to make the investment more feasible.

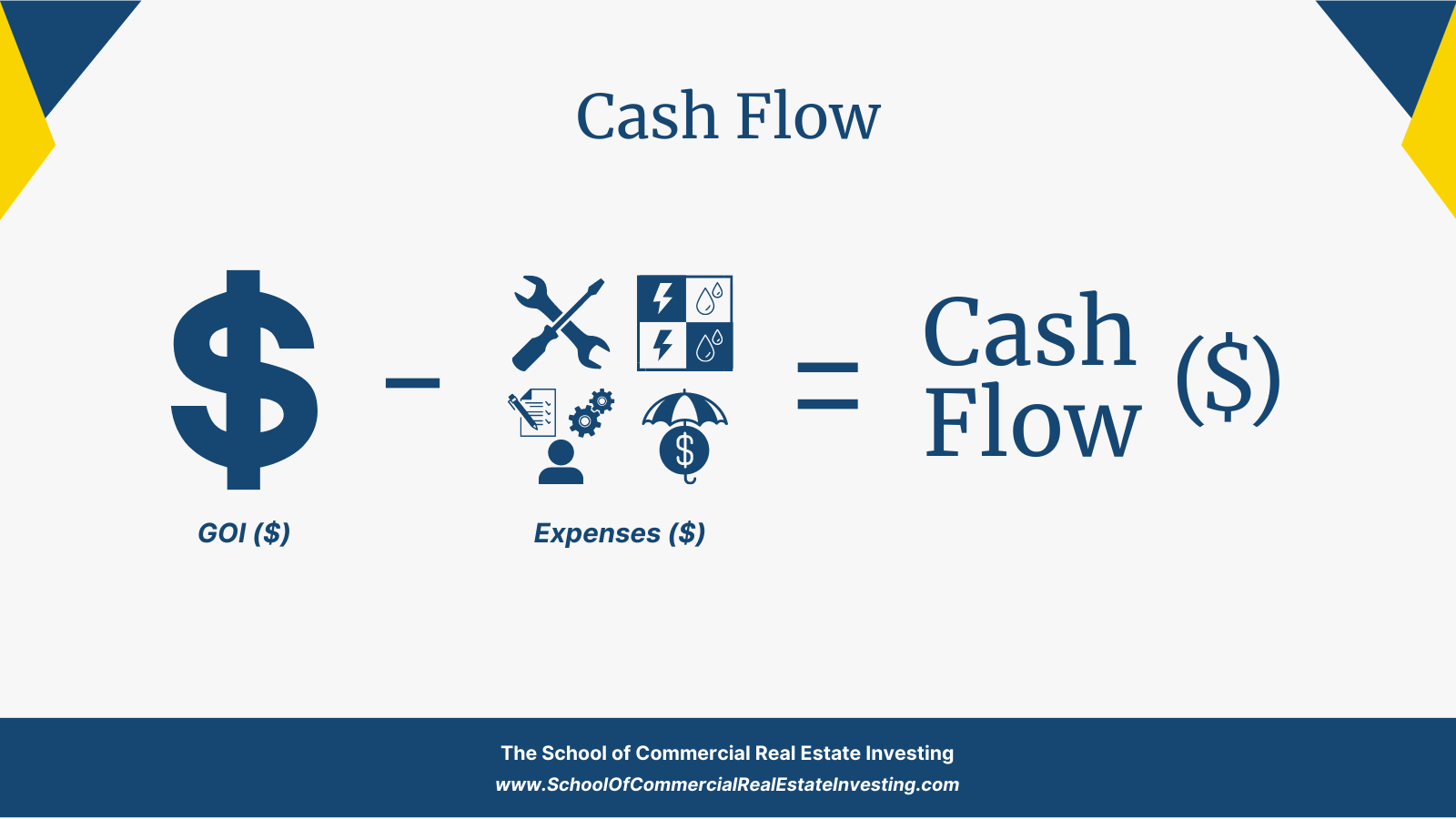

7. Cash Flow

Cash flow is a critical financial metric in real estate investing that calculates the net amount of cash a property produces after deducting all operating expenses, mortgage payments, and other financial obligations. It measures the property’s ability to generate positive cash flow or profit from its investment.

Cash flow is calculated by subtracting all monthly expenses (including allocated expenses such as a percentage of income dedicated to capital expenditures or a percentage of income dedicated to covering tenant turnover) from all monthly income. In formula form: All monthly income – all monthly expenses = cash flow.

Positive cash flow is critical to real estate investors because it ensures their rental properties are profitable and their investment is financially stable. Negative cash flow indicates the investor is losing money every month by owning the property, which can quickly lead to financial instability and investment loss.

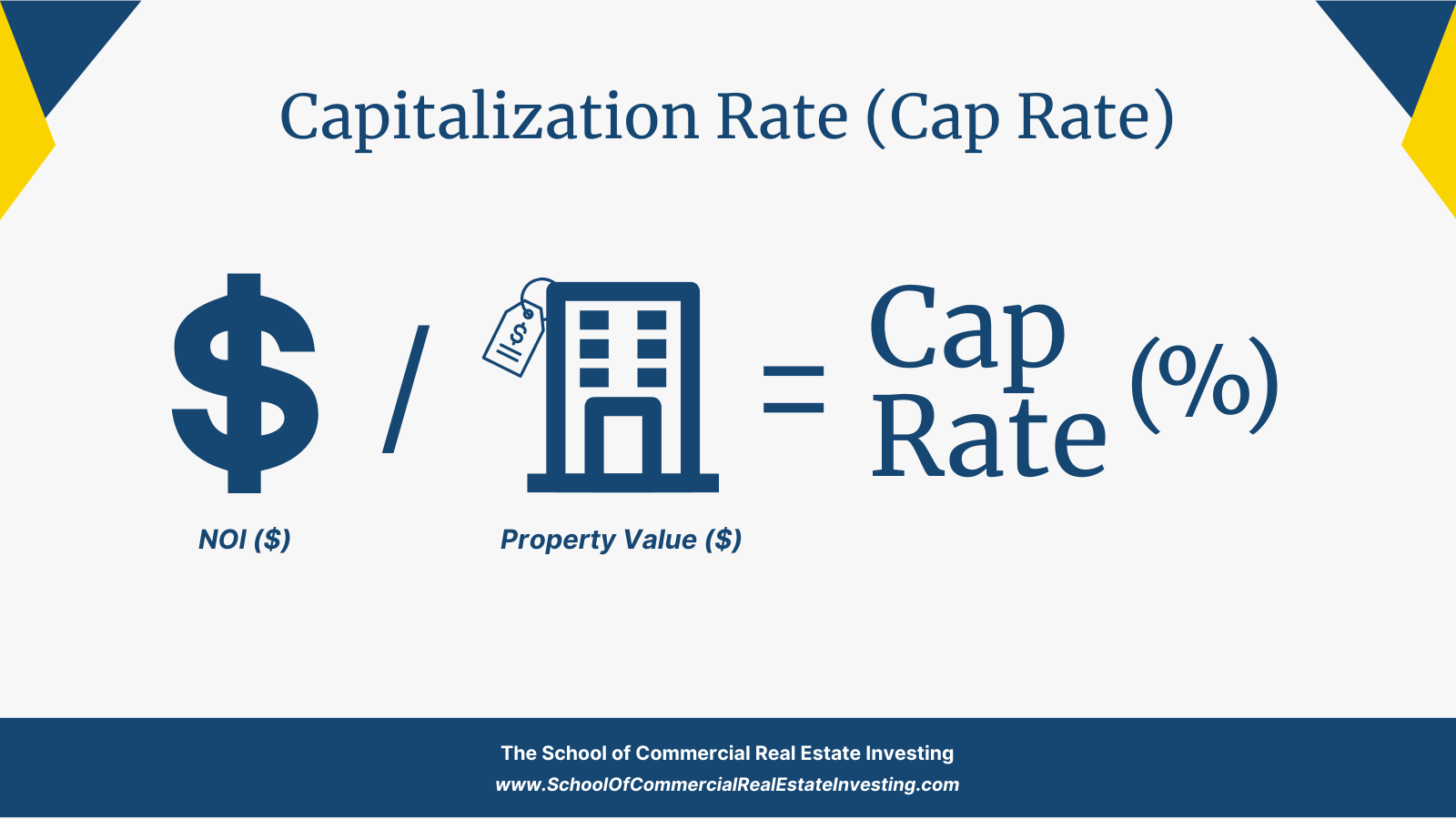

8. Capitalization Rate (Cap Rate)

Capitalization Rate (Cap Rate) is a critical metric used in real estate investing to determine the potential return on investment for income-producing properties. It is calculated by dividing a property’s NOI by its current market value or purchase price. In formula form: NOI / Current Market Property Value = Cap Rate.

Cap Rate helps investors evaluate an investment property’s financial feasibility by comparing the yield they can expect to receive to the current market value or purchase price.

By utilizing the NOI, Cap Rate includes local costs, such as property taxes based on the local property tax rate, and provides a single metric that investors can quickly use to compare one investment property to another. This allows investors to understand the typical cap rate in their market at any given time, which can help them avoid overpaying or underpaying for a property.

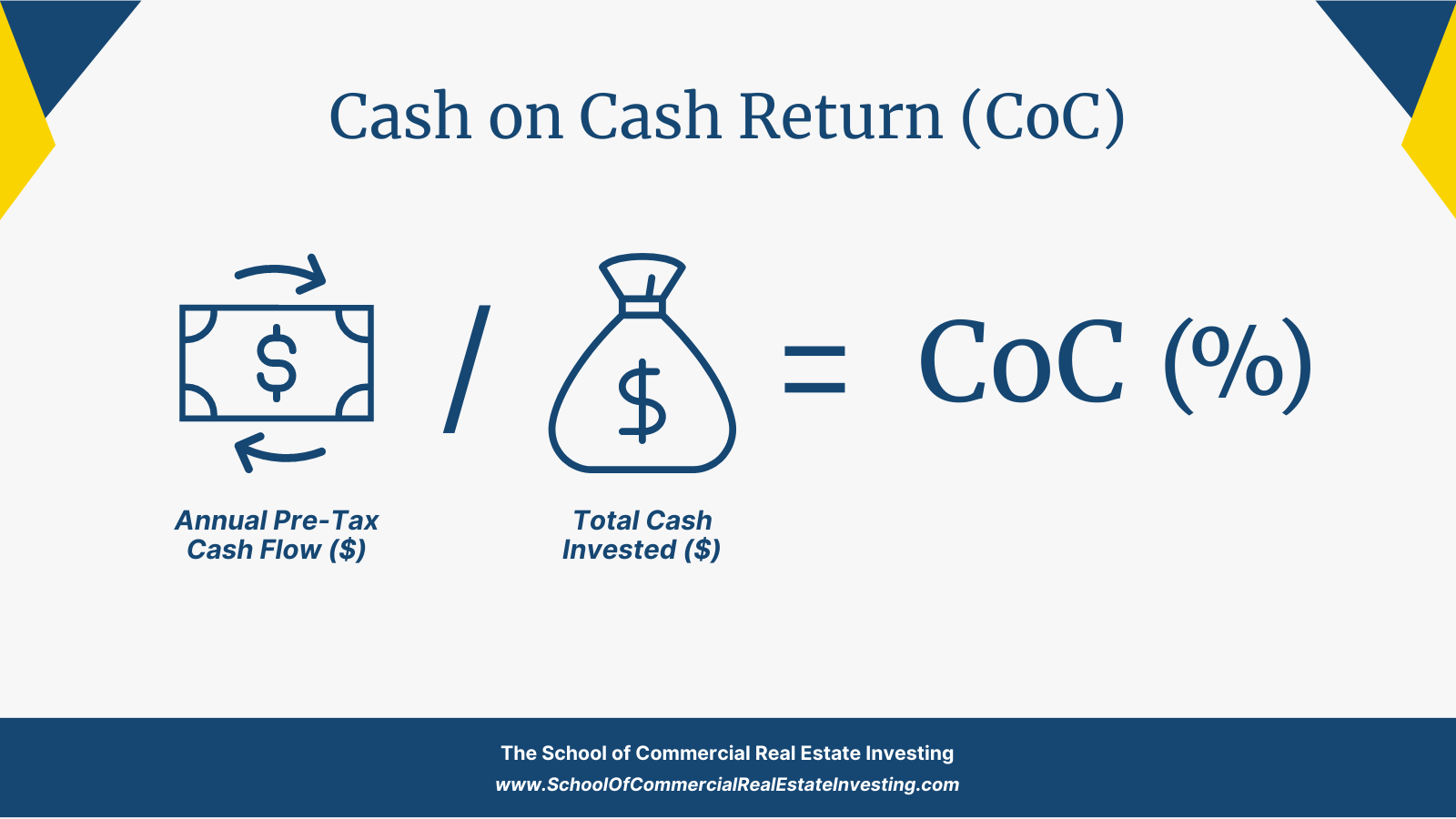

9. Cash on Cash Return

Cash on Cash Return (CoC) is a commonly used financial metric in real estate investing that calculates the return on investment (ROI) based on the actual amount of cash invested. This metric considers the cash flow generated by the investment property and compares it to the total cash invested by the investor(s).

To calculate CoC, divide the annual pre-tax cash flow by the total amount of cash invested. In formula form: Annual Pre-Tax Cash Flow / Total Cash Invested = Cash on Cash Return.

CoC Return enables investors to evaluate their investment’s performance (or potential profitability) in a cash-in-hand figure. Understanding CoC Return allows investors to evaluate the investment’s risk level by considering the amount of cash invested versus the property’s cash flow. By comparing the money invested to the cash flow, investors can determine if the investment is worth the risk and if it is likely to generate a satisfactory ROI.

As you may expect, investors usually aim for a higher CoC return, as it indicates that the investment will provide a more significant return on their investment.

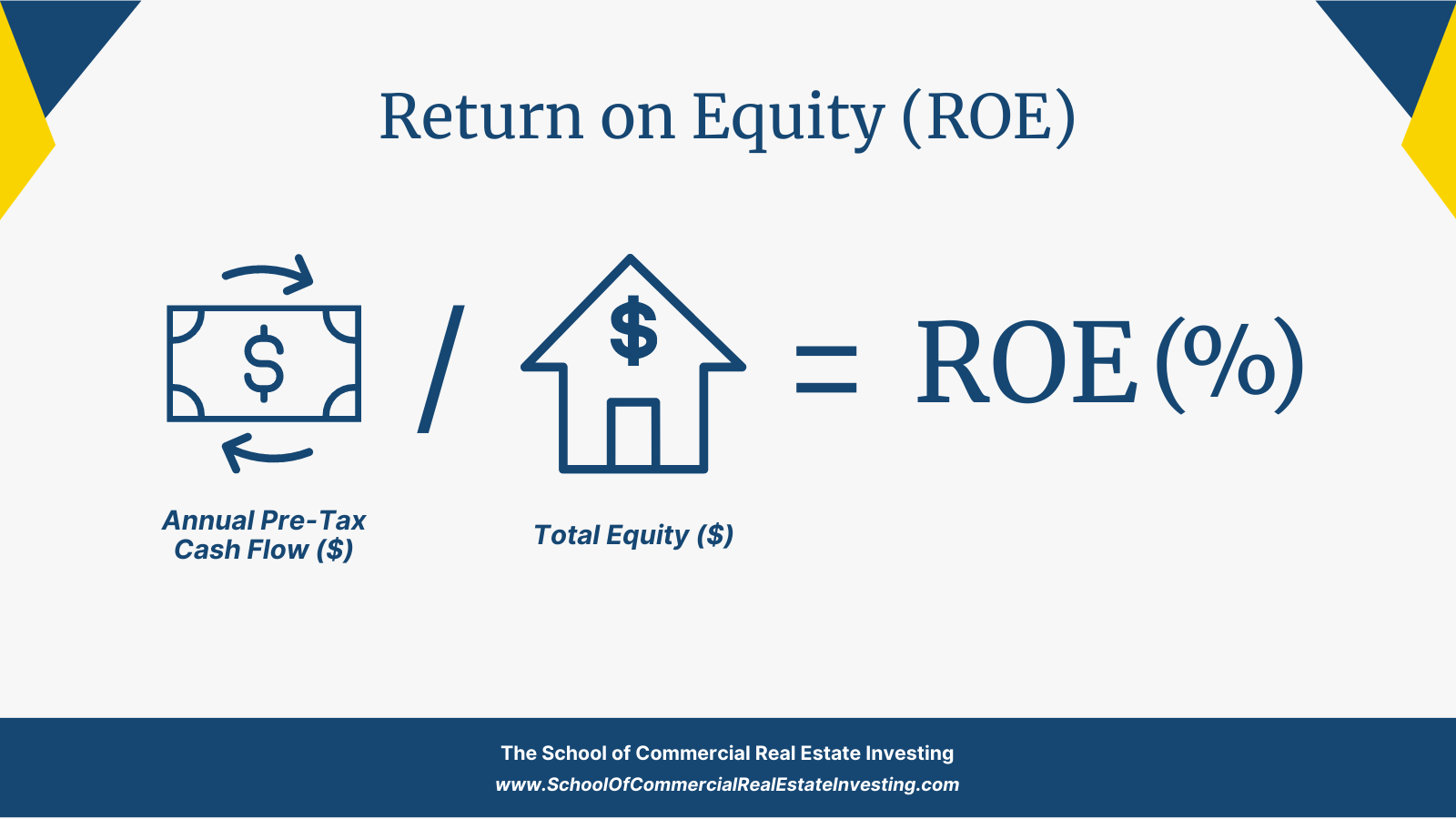

10. Return on Equity

Return on Equity (ROE) is similar to CoC in that it helps measure an investment property’s profitability. ROE indicates the percentage of return an investor receives based on the total amount of equity in the property.

To calculate ROE, divide the annual pre-tax cash flow by the total amount of equity in the property. In formula form: Annual Pre-Tax Cash Flow / Total Equity = Return on Equity.

ROE becomes a more valuable metric the longer an investor holds a property. The reason is that ROE’s significance lies in its ability to provide investors with a clear understanding of how efficiently they are using their capital to generate profits.

If an investor has 50% equity in a property based on current market values, and their ROE is only 3%, their capital/equity isn’t working very hard for them. So, rather than keeping 50% equity in that one property, it may be wise to refinance the property, pull 20% of the equity out, and use that to acquire a second investment property. In this example, the investor goes from having one property with 50% equity to two cash flowing properties (one with 30% equity and the other with 20% equity). This makes the capital work harder for the investor and could substantially increase their ROE.

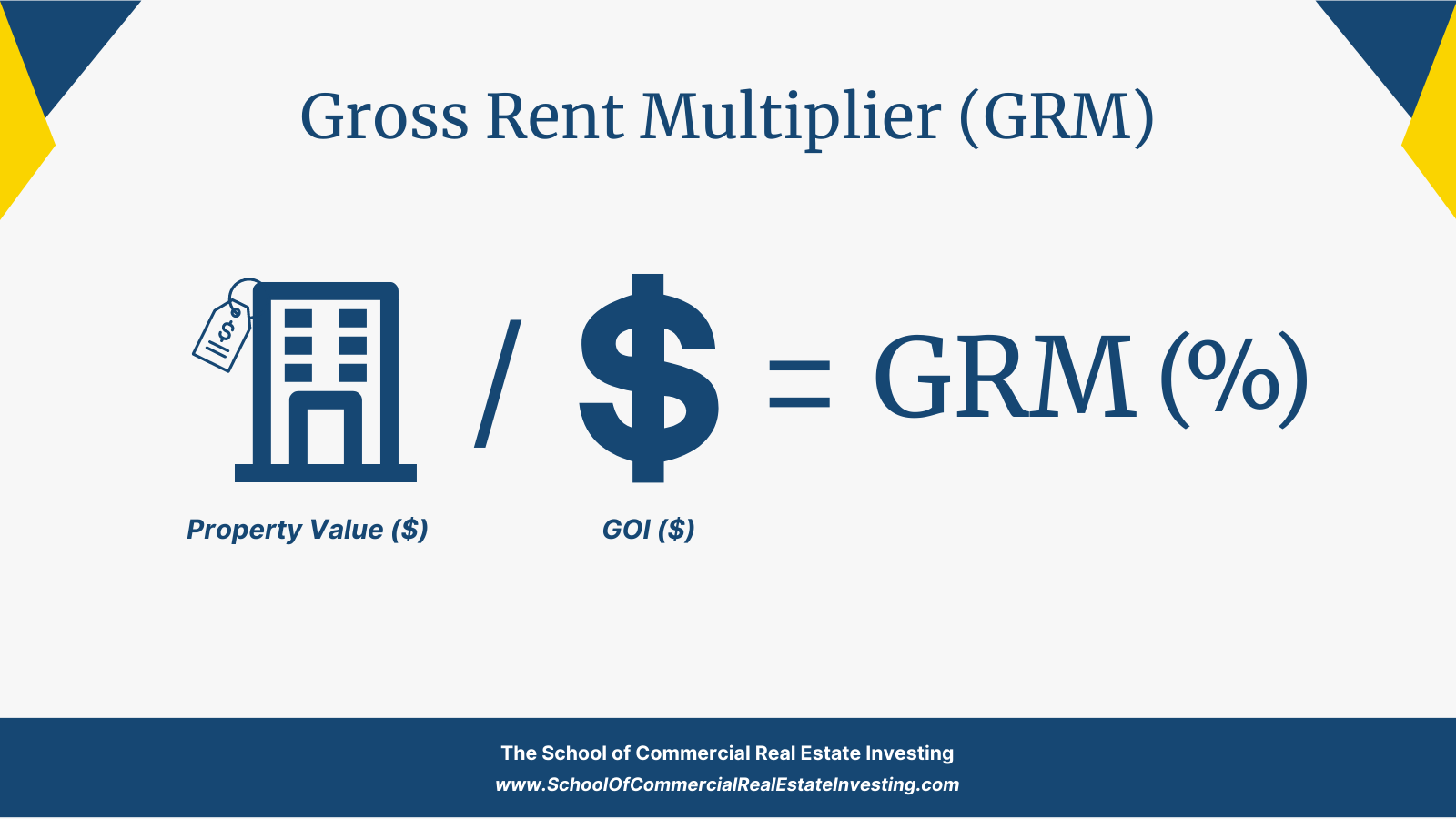

11. Gross Rent Multiplier Formula

The Gross Rent Multiplier (GRM) Formula is used to evaluate the potential income generated by an investment property. It is a simple mathematical calculation that determines the property’s value based on its rental income rather than considering other factors such as operating expenses, taxes, and annual interest rates.

GRM is calculated by dividing the property price by its gross annual rental income. In formula form: Property value / Gross Operating Income = GRM.

For example, if a property is sold for $1,000,000 and generates a gross rental income of $100,000 per year, the GRM will be 10 (i.e., 1,000,000/100,000).

The significance of GRM is its ability to provide investors with a quick and easy way to evaluate an investment property’s potential revenue stream. By comparing the GRM of different investment opportunities, investors can determine which property generates the most income per dollar invested.

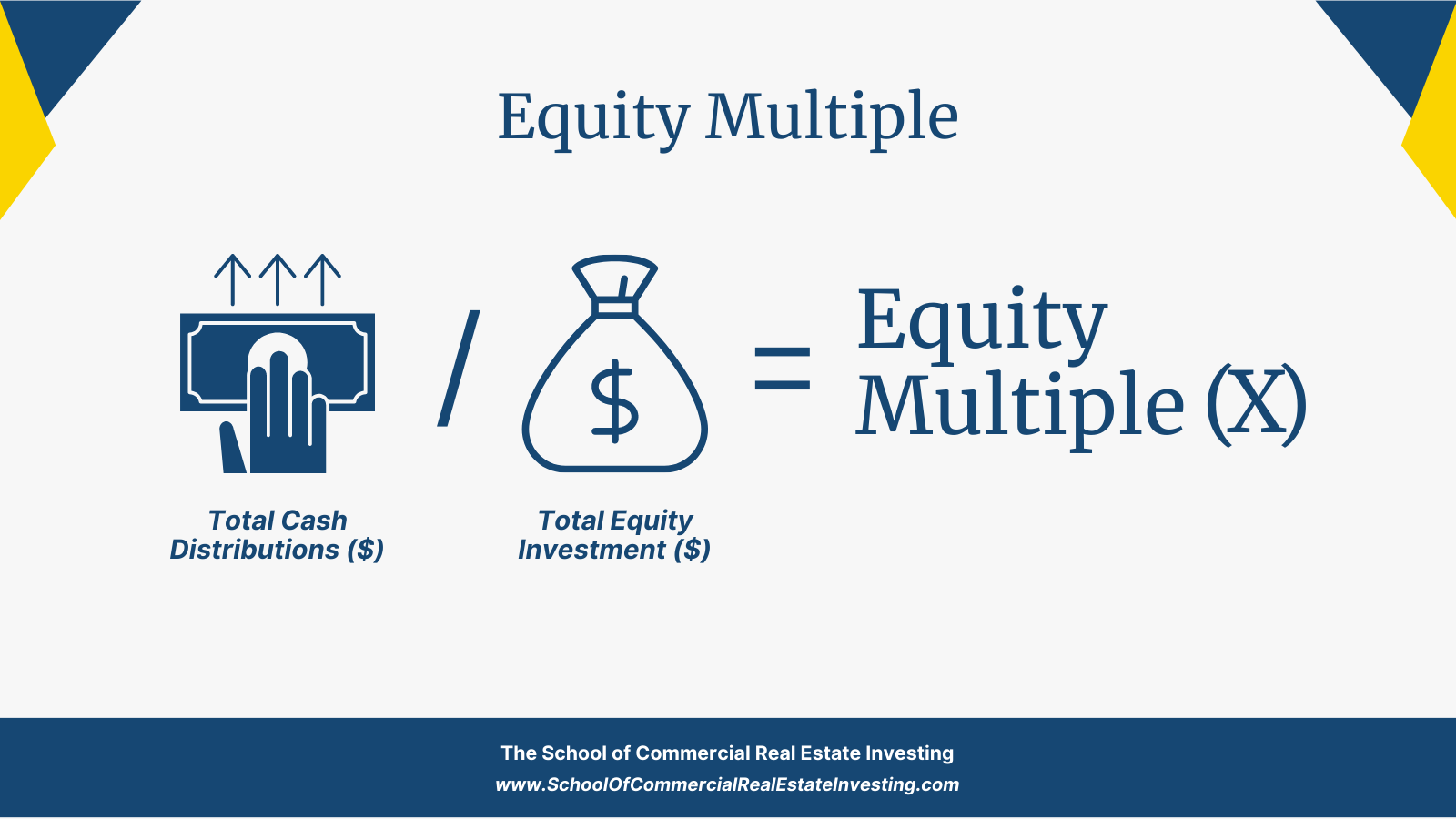

12. Equity Multiple

Equity Multiple is a financial metric used to measure the return on investment by considering the amount of equity a real estate investor invests. It refers to the ratio of the total amount of cash an investor receives from an investment property to the initial amount of money the investor has invested.

The Equity Multiple formula is calculated by dividing the total cash distributions from an investment property by the equity investment. In formula form: Total Cash Distributions / Equity Investment = Equity Multiple.

For instance, if an investor has invested $100,000 in a property and receives $300,000 in cash distributions over the property’s holding period, the Equity multiple will be 3x the principal amount.

The Equity Multiple metrics help real estate investors assess the potential returns on a property investment relative to the amount of Equity invested. By accounting for the time value of money, property appreciation or depreciation, leverage, and cash flow, it provides a more comprehensive picture of a property’s investment potential than other financial metrics, such as the annual gross rent multiplier or cap rate, which is solely based on rental income or net operating income.

Another advantage of Equity Multiple is that it considers both cash distributions and capital appreciation, two essential components of real estate investing. While cash distributions are stable and predictable sources of income, capital appreciation is the increase in the property’s value over time. It can also produce a substantial return on investment if the property is sold at a higher price than its initial acquisition cost.

One primary difference between Equity Multiple and ROE is how they’re expressed. Equity Multiple is expressed as a multiple represented by “x.” This means a 2x multiple doubles your initial investment, 3x triples your initial investment, etc. ROE is expressed as a yield represented by a percentage.

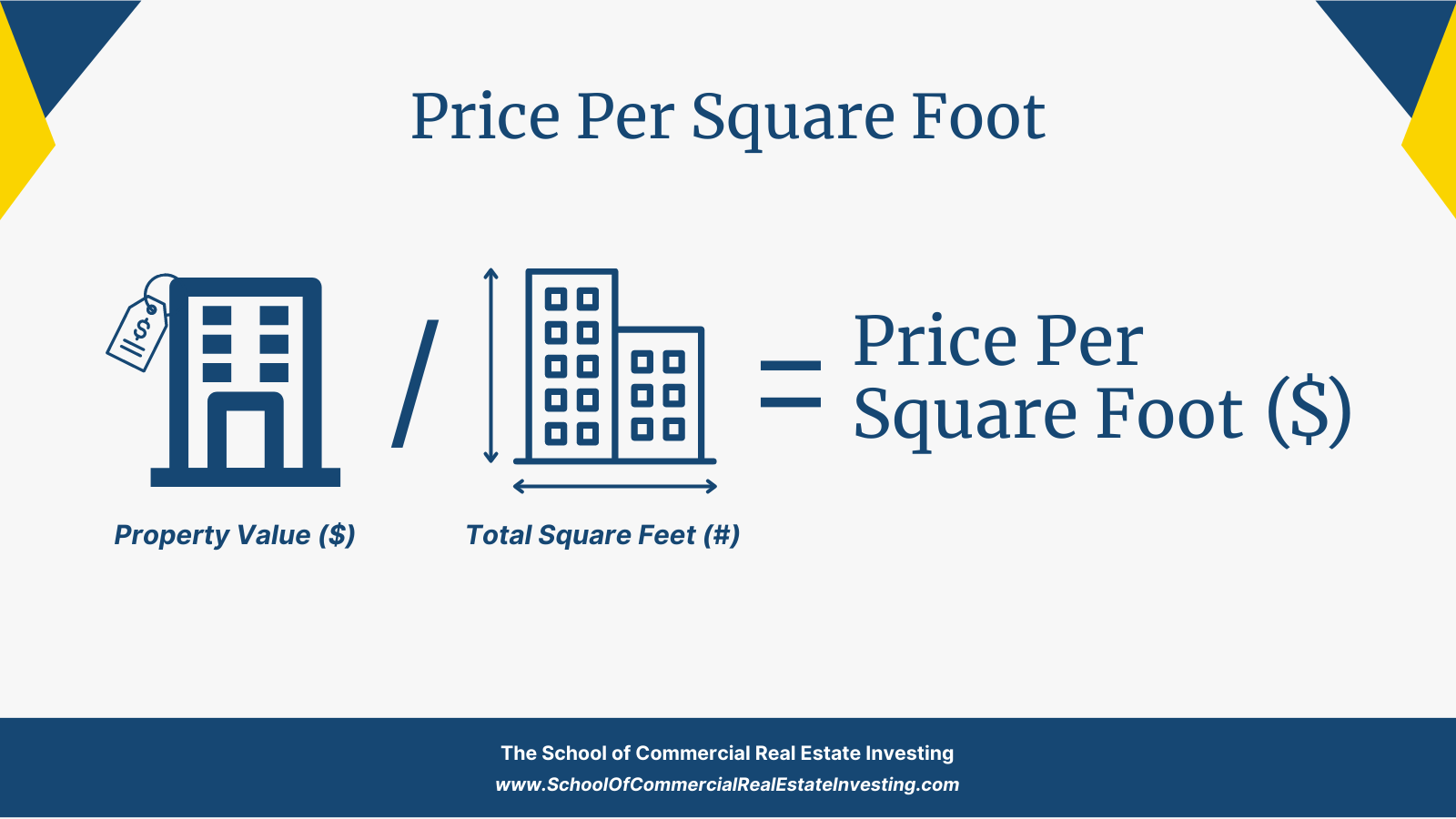

13. Price Per Square Foot

Price Per Square Foot is a commonly used metric in real estate investing, which measures the value of a property based on its size, as expressed in price per square foot. This metric is calculated by dividing the value of a property’s selling price by its total square footage, resulting in a price per square foot. In formula form: Sale Price / Property Square Feet = Price Per Square Foot.

Price Per Square Foot is a valuable number for real estate investors to compare the value of different properties based on their size. By analyzing and comparing the Price Per Square Foot of multiple properties in a given area, investors can identify local real estate market trends and help determine whether a property is overpriced or undervalued.

Moreover, Price Per Square Foot considers the physical attributes of a property, such as its location, age, condition, and amenities, which can significantly impact its value. For instance, a property in a desirable neighborhood with high-quality finishes and modern appliances will likely have a higher Price Per Square Foot than a less desirable location with outdated features and poor maintenance.

Another benefit of Price Per Square Foot is its use to estimate the construction or renovation cost. By analyzing the Price Per Square Foot of comparable properties in the same area, investors can estimate the cost to build a similar property or renovate an existing one. This information can be valuable in determining whether a property investment is financially feasible.

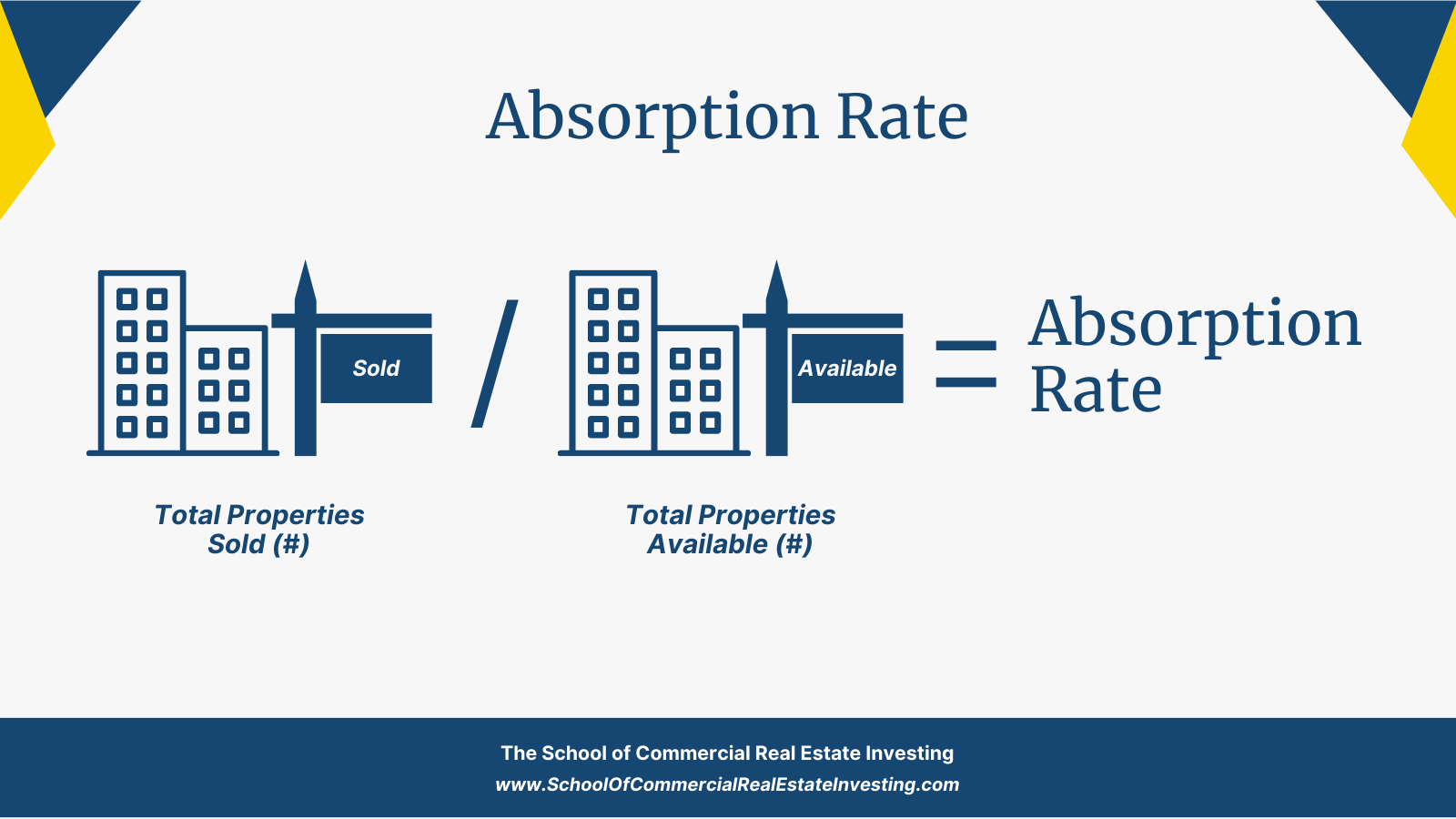

14. Absorption Rate

The absorption rate is a critical metric in real estate that measures the pace at which available properties are sold or leased within a specific market during a specified period. It is a powerful tool for real estate investors to evaluate a market’s supply and demand dynamics, forecast market trends, and determine the viability of a real estate investment opportunity.

To calculate the absorption rate, you must first determine the total number of properties available in a market, then track the number of properties sold or leased during a particular period, typically monthly or quarterly. Once this data is gathered, the absorption rate is calculated by dividing the number of properties sold or leased during the period by the total number of available properties. In formula form: Number of Properties Sold / Total Number of Properties Available = Absorption Rate.

The absorption rate provides investors with crucial insights into market conditions, including the market’s competitiveness, the rate at which properties are sold, and the demand for properties in a particular area.

Additionally, the absorption rate can help investors identify the optimal time to purchase or sell a property, depending on whether the absorption rate is high or low. For example, a high absorption rate typically indicates a seller’s market, where the demand for properties exceeds supply and properties sell quickly at higher prices. In contrast, a low absorption rate may indicate a buyer’s market, where there is a surplus of available properties, resulting in lower prices.

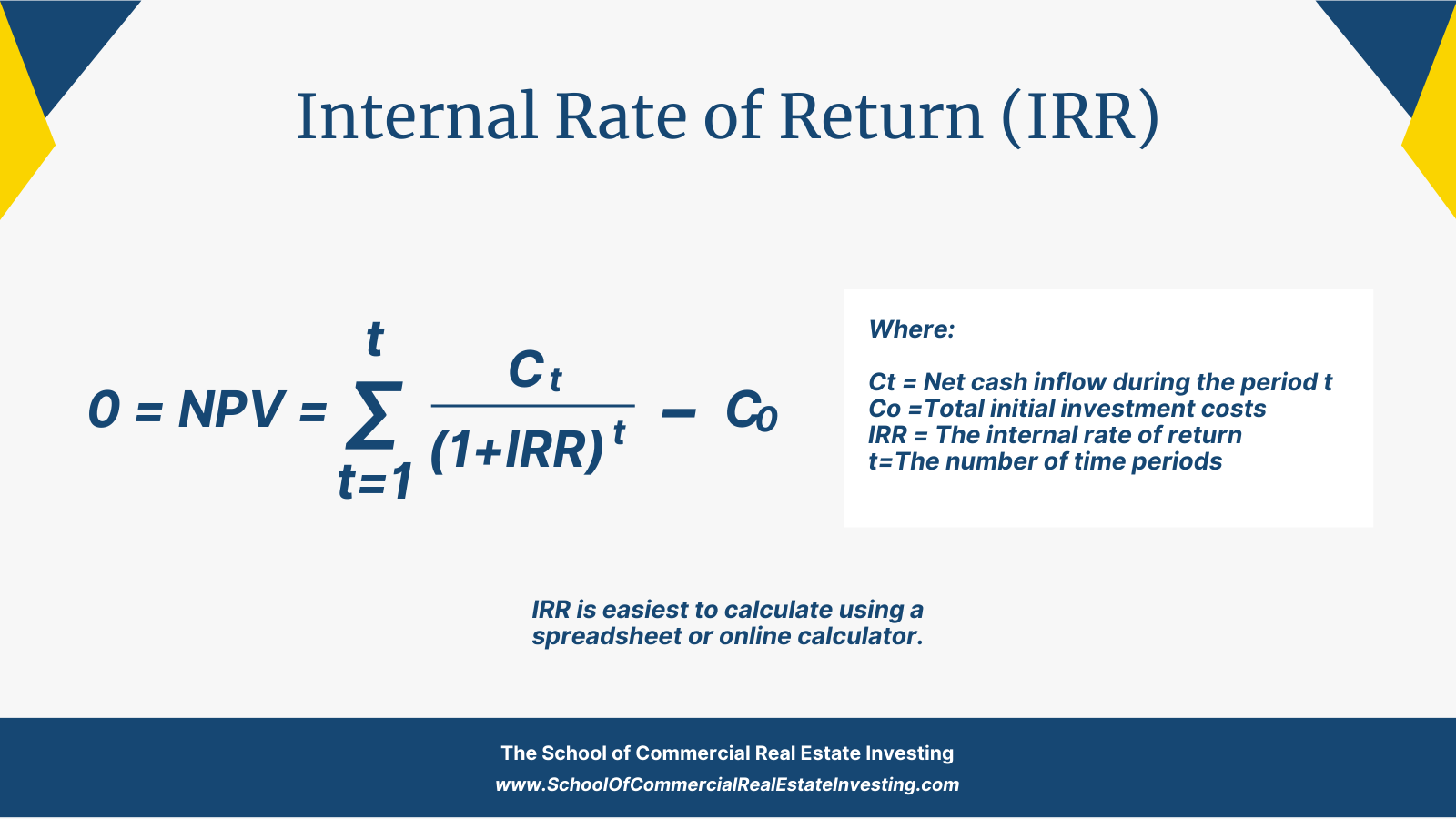

15. Internal Rate of Return (IRR)

Internal Rate of Return (IRR) measures a potential investment’s profitability. It is a financial metric that measures the rate or return of an investment based on all cash inflows and outflows during a specific period. In the context of real estate, IRR refers to the rate of return an investor can expect to earn on a property investment over the holding period, typically several years.

IRR is calculated based on several factors, including the initial investment amount, future cash flows from the property, and the expected sale price at the end of the holding period. The calculation considers the time value of money, which means that a dollar earned today is worth more than a dollar earned in the future.

By analyzing IRR, real estate investors can evaluate the potential profitability of an investment and compare it to alternative investment opportunities. A higher IRR indicates a more profitable investment, while a lower IRR suggests a less fortunate investment opportunity. Thus, IRR allows investors to decide whether to invest in a particular property or pursue other investment opportunities.

Real Estate Calculations Summary

Real estate formulas and calculations are an essential part of real estate investing. Everyone involved in a real estate transaction—from both the seller and buyer, to active investors and passive investors, to real estate agents and lenders—uses these metrics to analyze deals and make decisions.

The real estate investing definitions associated with these essential real estate calculations are primarily what can make real estate math difficult at first. Once you become familiar with the terms, most of the calculations real estate investors use are simple to plug into a calculator and calculate within seconds.

The best way to become comfortable with the top real estate calculations is to start using them and fumble around with them a bit. The more you use them, the more you will recognize when you’ve made a mistake vs. when you have successfully computed them.

Lastly, if you’re beginning your commercial real estate investing journey, be sure to explore our complete guide to real estate investing for beginners.